Managing Data in Glacier - Employee

Overview:

Demonstrates the process of inputting and updating employee information into Glacier.Security Roles

Initiator(s): Employee as Self

Approver(s): N/A

Process Considerations:

- Glacier collects information from foreign nationals, and U.S. Permanent Residents, being paid by the University of Wisconsin. Information must be entered into Glacier, and related forms, reports and documents must be delivered to the appropriate office so that paychecks are reported and taxed correctly. Glacier also identifies tax treaty eligibility, if applicable.

- If you are in nonresident alien status and performing income activity for the UW from outside the U.S., you may not need a Glacier account. Please contact your institution for assistance.

- Your Glacier account will be automatically created for you. You will receive two instructive emails, one from support@online-tax.net (Glacier) and one from uwhradminstration@wisconsin.edu (UW Administration). Read the emails carefully and follow instructions to create and update your individual record. Be sure to check your junk mail folder for the emails.

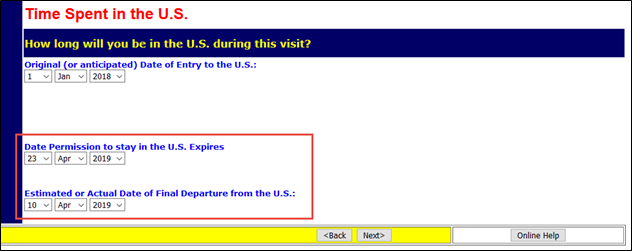

- The Date Permission to Stay in the U.S. Expires and/or Estimated or Actual Date of Final Departure from the U.S. dates must be updated to reflect accurate dates.

Enter Information into Glacier

- Navigate to Glacier and click Login Now.

- Enter the UserID and Password included in the email.

NOTE: You will immediately need to change UserID and Password and sign back in using that information. - Review the User Agreement and click I Accept.

- Select Create/Update/View my Individual Record and click Next.

- Enter information into Glacier, navigating through each page by clicking Next.

NOTE: if you need assistance entering information into Glacier, contact Glacier support at support@online-tax.net or click the Online Help link. - Review the summary of information on the Tax Summary Report page, then click Next.

- Click Print Forms button on the View and Print Forms page.

- Click Next go to the Exit and Save page.

- Sign and deliver all forms printed from Glacier and all documents listed in the lower right corner of the Tax Summary Report to your institution. Also, provide a copy of your Employment Authorization Card (EAD) or Permanent Residence Card (‘green card’), if applicable.

WARNING: On the W-4, if you are in nonresident alien tax filing status, do not change any values. If you are a resident alien or permanent U.S. resident status, fill in boxes 3 and 5.

Update Exit or Expiration Date in Glacier

- Log into Glacier.

- Click the Create/Update/View Record radio button.

- Click the Next button to navigate to the Time Spent in U.S. page.

- Update date fields in Date Permission to Stay in the U.S. Expires and/or Estimated or Actual Date of Final Departure from the U.S.

NOTE:- Date Permission to Stay in the U.S. Expires – end date of current immigration status (as listed on i20, DS-2019, I-797, EAD, or other)

- Estimated or Actual Date of Final Departure from the U.S. - date expecting to leave and remain outside the U.S. for at least 365 days

- Click the Next button to navigate to the View and Print Forms page.

NOTE: Review and update information in Glacier as needed. - Click the Print Forms button.

- Click Next to finalize information.

- Click Exit.

- Print, sign and deliver documents including required forms to the location identified on page two of the print out.

WARNING: Do not email forms.

Additional Information about Glacier Fields

Permanent Foreign Address – If your current immigration status is U.S. Permanent Resident, and you no longer have a foreign address, list your U.S. address and for country, select ‘other’.

Relationship - Your payment relationship with the University of Wisconsin refers to your job title. If you will be paid on multiple titles, you may need to select more than one relationship. If you are an employee earning wages, select the Employee/Staff/Faculty/Student/Research Assistant relationship type in Glacier. If you have a non-service scholar/fellow/trainee position, such as Fellow, Post Doctorate Fellow, Scholar, Post Doctorate Scholar, Trainee, Post Doctorate Trainee, Graduate Intern or Graduate Trainee, select the Scholar/Fellow/Trainee relationship. If you are not certain about your position title, contact your hiring department. Select all relationships which could apply during your time at the University of Wisconsin. Do not remove a selection even after a position has ended.

Income Type - This is based on your position title/payment relationship with the University of Wisconsin. If you selected the Employee/Staff/Faculty/Student/Research Assistant, then select the income type of Compensation/Wages/Salary. If you selected a Fellow, Scholar, or Trainee relationship, then select the income type of Scholarship or Fellowship (Non-Service). Best practice is to select all income types which could apply during your time at the University of Wisconsin. You should not select ‘no payments’ even after all your positions have ended.

Name – List your First Name/Personal Name (given name), Middle Name, and Last Name/Surname/Family Name in the correct fields. List your name exactly as it appears on your passport.

U.S.- Issued Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) - If you are an employee earning wages, you must enter your Social Security Number. If you are only receiving a non-service scholarship or fellowship and do not already have an SSN, enter your ITIN. If you do not have the number needed, indicate whether you have applied. Note: Do not select ‘applied for ITIN’ unless you applied through your institution and have a copy of Form W-7 signed by Jose Carus at UW Madison.

Details on the SSN/ITIN application process are available

- For all institutions except UW-Madison: uwservice.wisc.edu/docs/publications/pay-ssn-itin-process.pdf

- For UW-Madison: https://uwservice.wisconsin.edu/docs/publications/pay-ssn-itin-process-a.pdf

NOTE: UW payroll will not apply a tax treaty withholding exemption, if applicable, until an individual enters the appropriate TIN into their Glacier account and delivers the required reports, forms and documents as listed on the Glacier Tax Summary Report.

Country of Citizenship – From the list, please select your Country of Citizenship. If you are a citizen of two countries, please select the country under whose documents you entered the U.S. For example, assume you are a dual citizen of France and Italy. When you entered the U.S., you presented your Italian passport and completed your immigration documents and INS interview using your Italian passport. Therefore, for this question, you should select Italy as your country of citizenship. If you are a dual citizen of the U.S. and another country, for U.S. tax purposes, you are treated as a citizen of the U.S. Please contact the Glacier administrator for your Institution as soon as possible.

Country of Tax Residence – From the list, please select your Country of Tax Residence. Although you may pay tax in the U.S, your Country of Tax Residence is the country to which you owe tax on your "worldwide" income. Typically, your Country of Tax Residence is the same as you Country of Permanent Residence; however, if you have lived in a country other than your Country of Permanent Residence immediately before coming to the U.S. to study/work, you may have established Tax Residency in that country.

Sponsoring Institution – Select the answer based on your current I-20, DS-2019, I-797 Form or EAD card.

Current Immigration Status and Instructions for U.S. Permanent Residents –

- If you are currently a U.S. Permanent Resident and were in a different status when first paid by the University, answer all questions but select ‘other status’ instead of ‘permanent resident’ as your current immigration status. After completing your entry, log out then back in and change your current immigration status to ‘permanent resident’.

- If you were a Permanent U.S. Resident before you were first paid by the University list Permanent Resident as your current status.

- For all others, list your current immigration status. Note: If you are in J status, select the option matching the wording in Section 4 of Form DS-2019. If it includes the word ‘student’, select the J ‘student’ status.

Time Spent in the U.S. –

- Original (or anticipated) Date of Entry to the U.S. - This should be the date you last entered the U.S. after an absence of one year or more. Entries and exits before and after that date, and any immigration status changes, will be captured on the following screens.

- Date Permission to stay in the U.S. Expires - List the end date on your current immigration documents (I-20, DS-2019, I-797, EAD card, Permanent U.S. Resident Card)

- Estimated or Actual Date of Final Departure from the U.S. -. This should be the date you will leave and remain outside the U.S. for 365 days or more. It should include all U.S. presence whether or not you will be at the University of Wisconsin. If your actual date is not known, estimate.

Immigration Status – The question about whether you changed your immigration status since you arrived in the U.S. for this visit, refers to the date you listed as your 'Original (or anticipated) Date of Entry to the U.S.'.

Days Present In the U.S. - How long have you been present in the US? Glacier will list the estimated number of days you were in the U.S. for each year. The estimate for the first year will be from the date you listed as your original entry date until the current date, or December 31, whichever is earlier. In the box to the right of each estimate, enter the number of days you were outside the U.S. during the period.

Prior U.S. Visits - Select the correct option and list any U.S. visits prior to your current one, if applicable. You must include all visits to the U.S. since 1985. If you had more visits than you can list, contact Glacier support for direction (support@online-tax.net).

Tax Treaty Exemption Verification - Do not select the option to claim a treaty withholding exemption if either scenario is true:

- If the treaty lists a dollar limit and you already received income from a non-UW institution during this calendar year.

- If the treaty contains a RETROACTIVE CLAUSE and there is a chance you will NOT leave the U.S. by the date you listed in Glacier and remain outside the U.S. for at least 365 consecutive days.

Claiming the treaty if either scenario is true could result in your owing additional tax when you file your annual U.S. and state income tax returns. It is better to decline the treaty in Glacier and claim it when you file (or amend) your income tax returns once you become certain the retroactive clause will not apply to you.

NOTE: Even if you had treaty applied to your paychecks and don’t owe additional tax, you must still file annual income tax returns. More information on filing tax returns is available at: https://uwservice.wisc.edu/tax/filing-resources.php

Additional Resources

Related KBs:

- N/A

Related Links:

- Social Security Number (SSN) and Individual Taxpayer Identification Number (ITIN) Requirements and Application Process (Non-Madison employees)

- Social Security Number (SSN) and Individual Taxpayer Identification Number (ITIN) Requirements and Application Process (Madison employees)